Expected Move For Next N Days

-

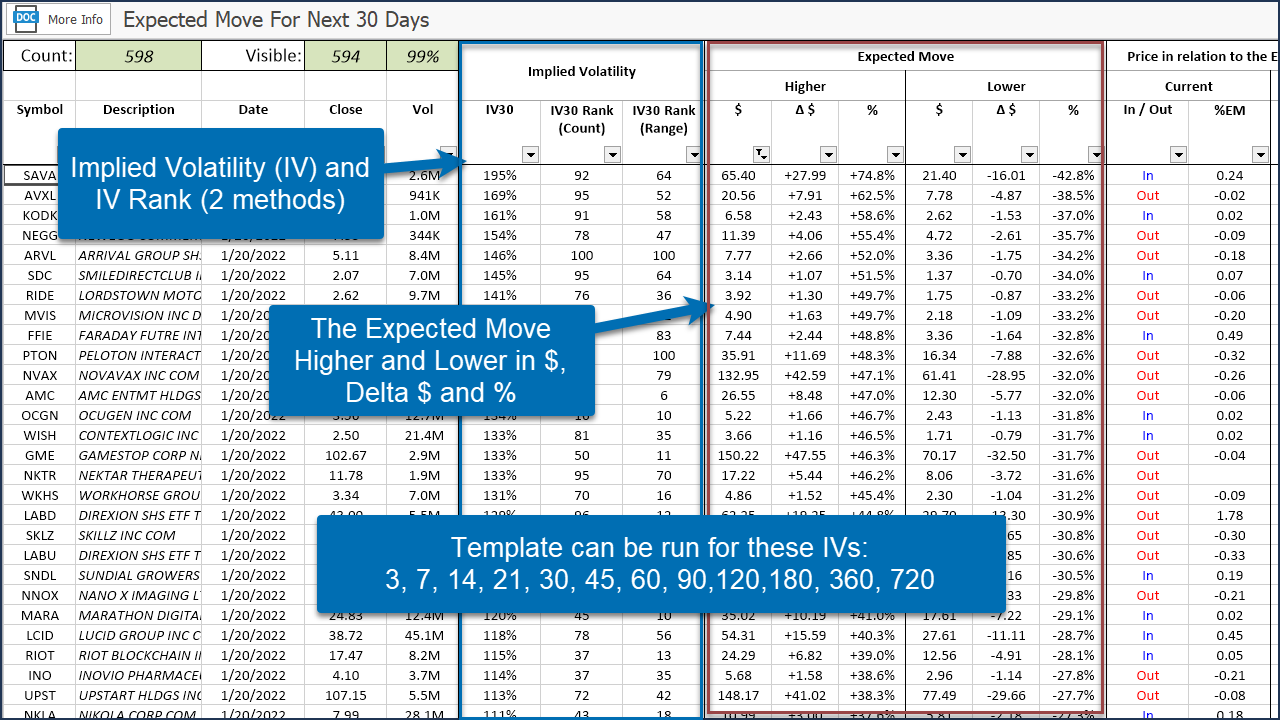

The Expected Move ReportShows Implied VolatilityExpected Move ($ and %)And where price is in relation to the expected move bands

The Expected Move ReportShows Implied VolatilityExpected Move ($ and %)And where price is in relation to the expected move bands -

The Chart Layout is pre-configuredTo show indicators relevant to the reportjust click on a report symbolto show the chart

The Chart Layout is pre-configuredTo show indicators relevant to the reportjust click on a report symbolto show the chart

Template Description

More Info

- CategoryOptions Analysis

- Links

Please subscribe to the EdgeRater YouTube Channel to be notified of new helpful videos