Linear Regression Standard Deviation Channel Analysis

-

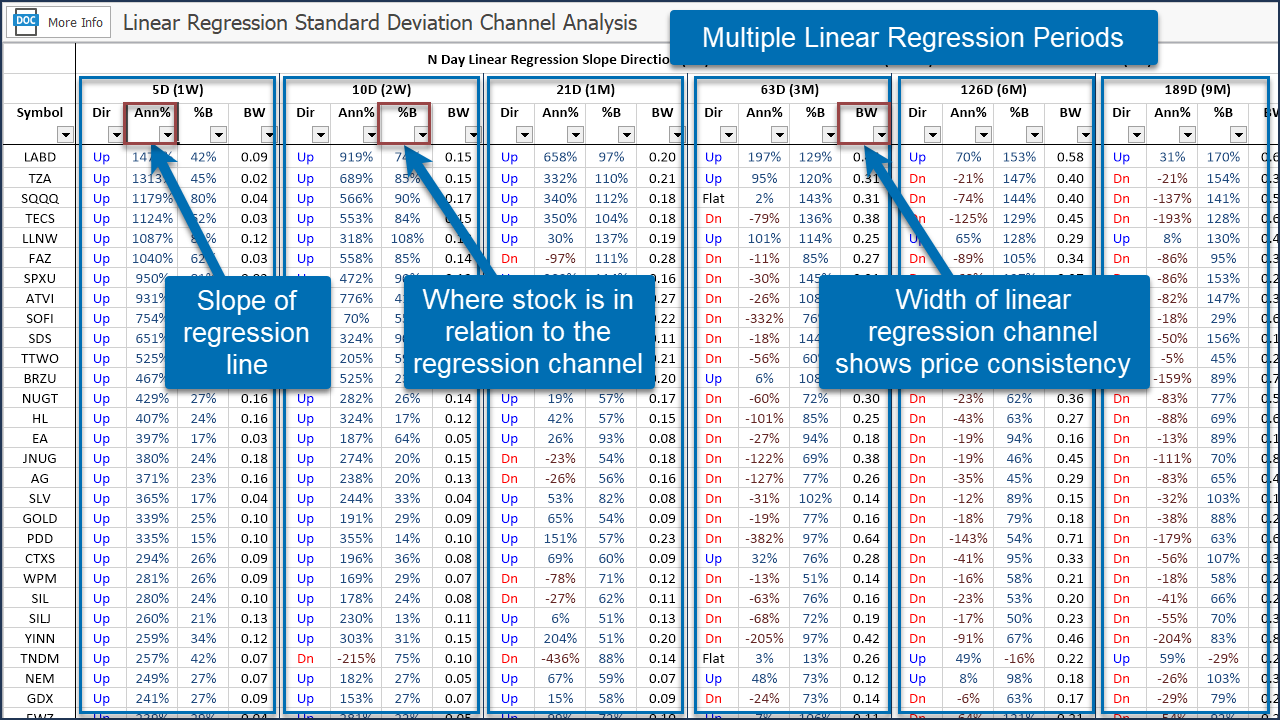

Linear Regression ReportMultiple regression periods calculatedEasily determine rate of rise and price consistencyAnd whether stock is at top or bottom of channel

Linear Regression ReportMultiple regression periods calculatedEasily determine rate of rise and price consistencyAnd whether stock is at top or bottom of channel -

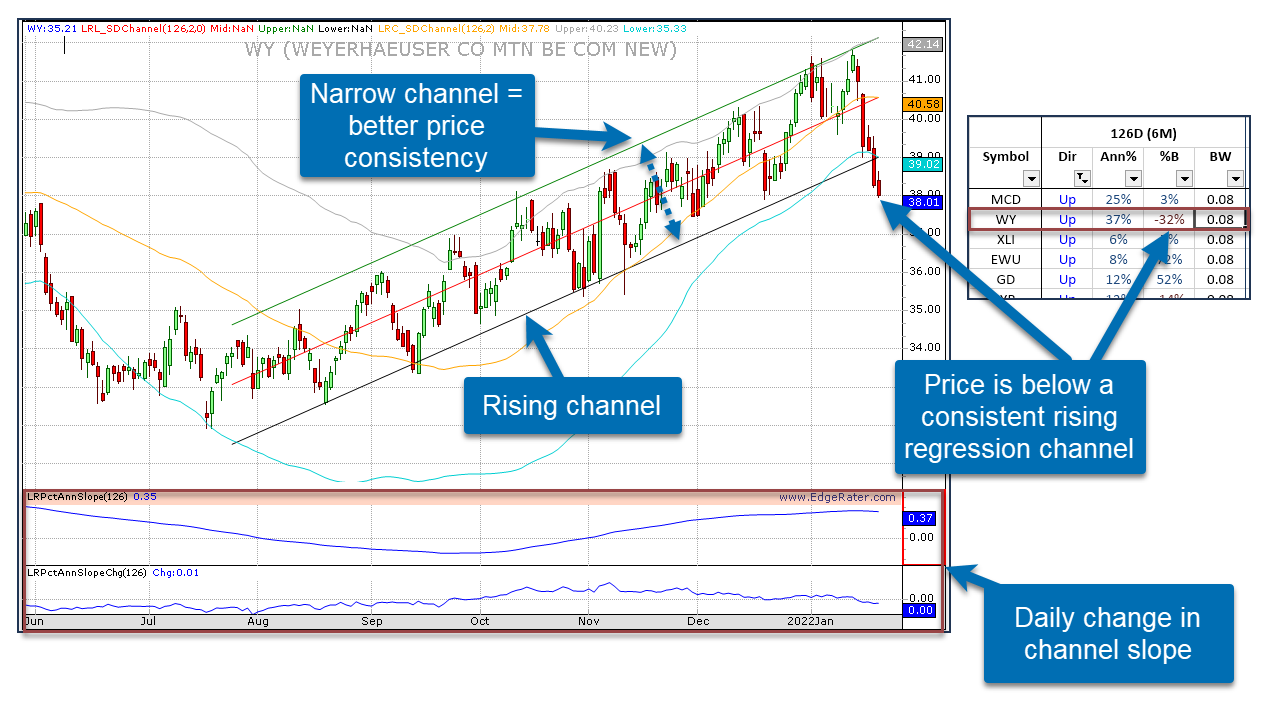

Linked chart shows regression channelAnd daily slope of channelAnd change in slopeJust click a report cell to show the chart

Linked chart shows regression channelAnd daily slope of channelAnd change in slopeJust click a report cell to show the chart

Template Description

More Info

- CategoryHot Topics

- Links

- Linear Regression Channel Analysis Video

- Blog Post - Linear Regression Analysis

Please subscribe to the EdgeRater YouTube Channel to be notified of new helpful videos